Ticker / Instrument: INDL – Direxion Daily India Bull 2x Shares (leveraged ETF)

Trade Type: Long position (shares)

Reason for Entry:

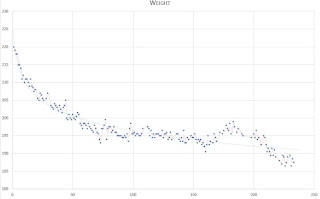

I entered this position after observing oversold technical conditions on the weekly chart. The Commodity Channel Index (CCI) had descended toward the –100 threshold, which historically suggests the asset is nearing an oversold zone. Momentum to the downside appeared to have stalled, with the CCI moving sideways rather than continuing its decline, signaling a potential shift toward stabilization or reversal.

Macro / News Backdrop:

This trade is being taken against a challenging macro environment for Indian equities:

-

Tariff Escalation: On August 6, 2025, President Donald Trump announced an additional 25% tariff on Indian goods, raising the total rate to 50%.

Risk Management:

Due to the negative trade news and potential for further geopolitical escalation, I am implementing a tight stop loss at –10%. The position is small and speculative, targeting a potential technical rebound rather than a long-term macro trend.

Goal / Exit Plan:

-

Primary Exit: Profit target based on a bounce from oversold levels toward the mid-range of recent trading.

-

Stop Loss: Immediate exit if price declines 10% from entry, to limit downside exposure in the event tariffs continue to pressure Indian equities.

Notes:

Will monitor:

-

Technical behavior around the –100 CCI level.

-

Any signs of reversal on the weekly chart (CCI crossing upward).

-

Developments in U.S.–India trade negotiations or changes in tariff policy. -

Broader emerging market sentiment, as INDL could be influenced by shifts in global risk appetite.