My decision to sell PICK. Was it unwise? Only time will tell.

The figure above shows around when I bought shares and the last point shows my exit point for several of the shares bought.

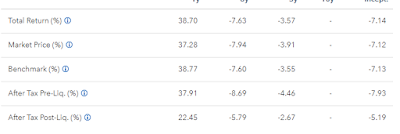

PICK is the stock symbol for iShares MSCI Global Metals & Mining Producers ETF. Its current value as of yesterday’s close was $32.57, and its one-year total return is 27%. However, its historical returns are negative – see below.

I choose to purchase PICK for the fund because its stock price was at a low and produced high dividends. To make my decision to sell PICK, I used my portfolio control algorithm, implemented in a Google Sheet, to make the decision for me. My assumptions are a 50% probability that the stock may go up/down, and that I have a max to initially invest of $1600 in PICK – and I want to make a decision once a month. The algorithm is investment conservative – e.g., avoid losses. See figure below which compares the average return of the conservative method verse a lump sum investment in PICK.

The algorithm running on historical data made the following buy/sell decisions.

Date

|

Decision

|

Shares / Total

|

Portfolio Value / Cash

|

09/01/2015

|

Buy

|

42 / 42

|

$1600 / $809

|

01/01/2016

|

Buy

|

8 / 50

|

$1439 / $703

|

04/01/2016

|

Sell

|

6 / 44

|

$1820 / 708

|

11/1/2016

|

Sell

|

7 / 37

|

$2047 / 872

|

01/01/2017

|

Sell

|

4 / 33

|

$2168 / 1077

|

Based on this analysis, I decided to sell several shares to reach 33 shares in my fund’s holding. I still have fractions of shares in this account. Therefore, I will continue with dividend reinvest with PICK until I approximate an even share amount.