Rethinking diet

In 1996 as a teenager I was becoming increasingly sick. I had blood in my stool nearly daily and uncontrollable fevers and chills. And I had lost my Appetite and would try to sleep all day. A few days after my 16th birthday, my parents took to a doctor because of a high fever and these symptoms. During, the checkup I passed out. I awoke in a hospital bed with medical professionals attempting to lower my fever. I ended up staying in the hospital for over a month. I was officially diagnosed with Crohn's Disease and put on a liquid diet of chicken and beef broth for about a month. The doctor’s prescribed a ton of medicine for me. However, the systems for Crohn’s didn’t disappear. I still had bleeding and outbursts of fevers.

I battled Crohn’s through my undergrad with medicine after medicine. I ate mostly bread and meats - but avoided veggies based on the recommendation of a doctor. I felt like crap most of the time. My immune system was weak because of the drugs.

In 2004 I came across a book on the specific carbohydrate diet that provided a diet that would alleviate the symptoms of my Crohn's disease. It removed complex sugars, e.g., refined sugars, bread, and pasta, from my diet which would kill off the bad bacteria that was assumed to be the underlying cause of my disease. The diet worked well. I was able to come off of my medicines. And my inflammation in the intestines, a symptom of Crohn's disease, decreased. I felt great and was easy for me to follow. However, I returned to eating ‘regular’ food around 2009. And I barely had any Crohn's symptoms or major reactions. Little to no fevers or blood in the stool. Life is good. Right?

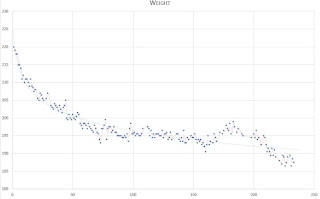

Well, before changing my diet from SCD to more ‘normal’ diet, I weighed around 165 lbs. Within the first year of returning to the ‘normal’ high sugar diet, I gained about 10-15 lbs of weight, likely all fat. Then in 2010, I crossed the 200 lbs mark - wow! My waist had gained 5 inches over two years! Over 2010 to 2012, my weight hovered around 190 - 210 lbs. Then when I started law school in 2012 I ate bread and sugary snacks all the time - I had too I thought, there were no other options. Really, I just craved those foods. By 2016, I reached 225 lbs.

Then over summer, I was researching ways to lower blood pressure, and I came across intermittent fasting. I tried it right away, and within the first 40 days, I was down 20 lbs! I have continued to intermittent fast, over 180 days now, and my weight fluctuates around 190 lbs. But, I am still eating the high sugar foods - bread and pasta. Can I do more?

Yes, I can. This year, I plan to try out a Ketogenic diet – high fat and low carb eating. The main reasons for my decision, are the number benefits from this diet. Such as more energy, reduction of inflammation, clearer thinking, and better mood stabilization (e.g., serotonin and dopamine levels are optimized)

Source: http://www.ketogenic-diet-resource.com/ketogenic-diet-benefits.html